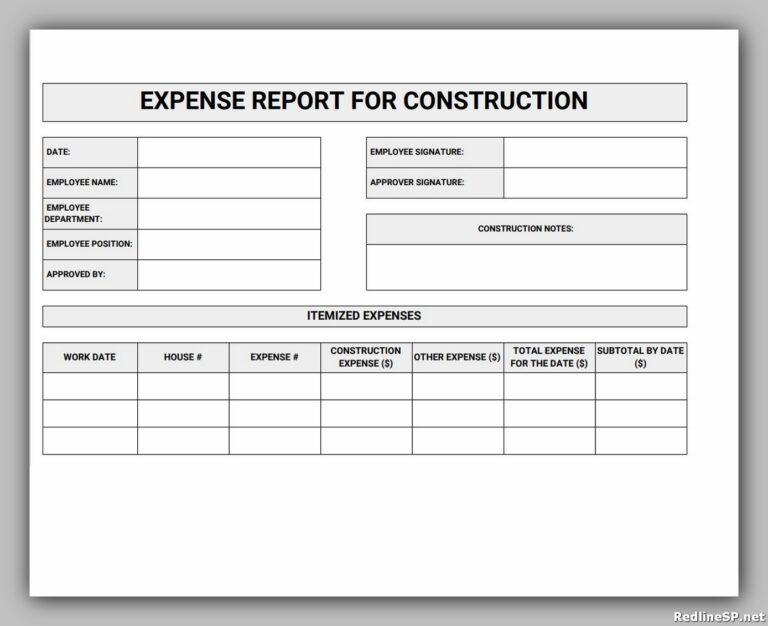

If a deduction is required, the contractor must: If no deduction is required, the contractor can make the payment to the subcontractor in full. This may require the contractor to make a deduction, which they then pay to us from that part of the payment that does not represent the cost of materials incurred by the subcontractor. Under the scheme, all payments made from contractors to subcontractors, must take account of the subcontractors’ tax status.

#CONTRACTOR EXPENSES LIST VERIFICATION#

We’ll check whether the subcontractor is registered with us and then tell the contractor the rate of deduction they must apply to the payment, or whether the payment can be made without any deductions.įor more information, read the verification process. 1.4 Verifying subcontractorsīefore a contractor can make a payment to a subcontractor for construction work, they may need to verify with HMRC that the subcontractor is registered.

#CONTRACTOR EXPENSES LIST HOW TO#

We’ll provide registration details that contractors and subcontractors will need to use when they deal with payments.įor information on when and how to register, read Registering for the scheme. Subcontractors who do not wish to have deductions made from their payments at the higher rate of deduction should also register with us. 1.3 Registering for the schemeĪll contractors must register with HMRC for the CIS. When they’re working as a contractor, they must follow the rules for contractors and when they’re working as a subcontractor, they must follow the rules for subcontractors.įor a more detailed explanation of what is a contractor and what is a subcontractor, read Section 2. Many businesses pay other businesses for construction work, but are themselves paid by other businesses too. Businesses that are contractors and subcontractors SubcontractorĪ subcontractor is a business that carries out construction work for a contractor. Private householders are not counted as contractors so are not covered by the scheme. The rules require a business to monitor construction spend regularly. Some businesses or other concerns are counted as contractors if they have spent more than £3 million on construction within the previous 12 month period. ContractorĪ contractor is a business or other concern that pays subcontractors for construction work.Ĭontractors may be construction companies and building firms, but may also be government departments, local authorities and many other businesses that are normally known in the industry as ‘clients’.

Under the scheme, the terms ‘contractor’ and ‘subcontractor’ have special meanings that cover more than is generally referred to as ‘construction’. The scheme covers all types of businesses and other concerns that work in the construction industry, including: 1.2 Types of businesses that are covered by the scheme There is more information on businesses not resident in the UK at Section 5. There is more information on the scope of the scheme in paragraphs 2.18 to 2.20 and in Appendix A. However, a business based outside the UK and carrying out construction work within the UK is within the scheme and must register accordingly.

The scheme does not apply to construction work carried on outside the UK. The UK includes UK territorial waters up to the 12 mile limit. The scheme covers all construction work carried out in the UK, including jobs such as: 1.1 Types of work that are covered by the scheme This may require the contractor to make a deduction, which they then pay to HMRC, from that part of the payment that does not represent the cost of materials incurred by the subcontractor. Under the scheme, all payments made from contractors to subcontractors must take account of the subcontractor’s tax status as determined by HMRC. The scheme sets out the rules for how payments to subcontractors for construction work must be handled by contractors in the construction industry and certain other businesses. This section gives a brief introduction to CIS. Introduction to the Construction Industry Scheme ( CIS)

0 kommentar(er)

0 kommentar(er)